Turkish dominance at risk

Turkey has been the leading hazelnut producer for decades – and therefore the main supplier for most of confectionery companies – despite growing concerns about child labour, a lack of product traceability, the absence of Good Agricultural Practices and an average quality that is even deteriorating, especially in the eastern part of the country, where more than two thirds of the cultivated areas are located. The main consequence is that world prices have long been defined as a function of the balance between world demand and the level of Turkish production.

But today, the situation is rapidly evolving: many investments have been made in many other countries and Turkey is losing ground. Why?

High prices and increasing profitability

The reasons are purely economic. Hazelnut cultivation, which has long been a good investment in suitable areas, has suddenly become incredibly popular and is now considered as a valid alternative to other valuable types of cultivation.

The main reasons include:

1) A supply shock

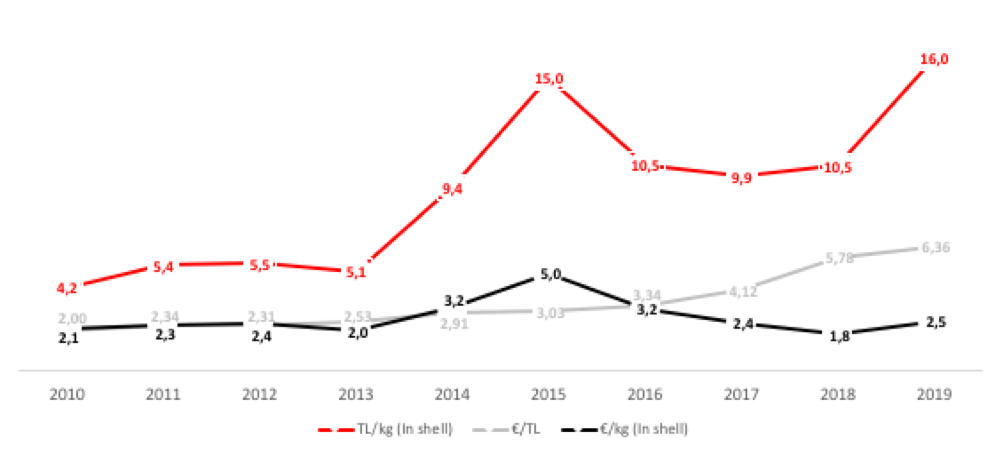

This was due to the frost that hit northern Turkey – and more than half of the hazelnut crop – in April 2014. Just when global demand was increasing, the frost drove up the market prices as it had never happened before, with effects lasting two seasons, due to poor levels of stocks accumulated by buyers and their subsequent need for supplies. Figure 1 shows how the average price increased by 84% from 2013 to 2014, and by a further 60% the following year. So, in the end, prices have gone up by a factor of 3 in the 12 months following the frost.

This event was the main reason why hazelnut cultivation was seen for the first time – everywhere in the world – as an interesting alternative source of income, despite the fact that the investment takes five years to generate the first revenues and about ten years to reach break-even point. It should be noted that goods coming from countries like Italy are known to be of higher quality, which makes the investment even more interesting. By way of example, in Lazio the price of in shell hazelnuts reached € 5.80/kg in the spring of 2015, for a total revenue of € 15,000 per hectare against management costs ranging between € 2,000 and € 3,000! A comparison with the yields of the annual crops inevitably led to the productive conversion of large areas.

Fig. 1 – Price of in shell hazelnuts, Turkey (2010-2019)

2) The initiatives taken by confectionery companies.

Some major confectionery companies have actively promoted hazelnut cultivation in order to no longer have to depend on Turkey and to increase the availability of quality hazelnuts. Ferrero Group, the world’s largest consumer of hazelnuts, has done a lot to achieve this goal: towards the end of 2014, Ferrero and ISMEA signed a memorandum of understanding with the aim of promoting the development of Italy’s hazelnut sector and increasing the cultivated area in Italy by 20,000 ha in five years. Other initiatives included direct investment and other forms of cooperation in Serbia, Azerbaijan and North America.

More recently, Loacker – a major company based in South Tyrol – has also launched a project to create its own hazelnut supply chain with over 2,000 hectares converted from different existing crops. It is not surprising that the area where hazelnuts are grown in Italy has increased by 20% in 5 years: from 72,215 ha in 2014 to 86,725 ha in 2019 (ISTAT).

3) Price support policies in Turkey.

This favorable investment environment, that could have been short-lived, has been strengthened by the activity of TMO, a public company active in the Turkish agricultural sector, that has purchased over 200,000 tons of in shell hazelnuts at a “fixed” price from 2017 until today, determining the implementation of a price support policy in Turkey.

The reason behind this choice is very simple: the production of hazelnuts is vital to the Turkish economy. It is the main source of income for over 200,000 families directly engaged in production, and many others involved as manpower, as agricultural mechanization is almost absent in Turkey, and therefore labour plays a key role at all stages, especially during the harvest period.

The contribution of this support policy was decisive for maintaining the international market price at interesting levels, especially in conjunction with the devaluation of the national currency, the Turkish lira (Fig. 1).

Table 1 – Worldwide production of in shell hazelnuts (t)

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| TOTAL | 711,623 | 1,082,464 | 842,788 | 1,186,281 | 1,066,699 | 1,178,435 |

| TURKEY | 381,167 | 680,286 | 462,216 | 750,000 | 570,000 | 717,910 |

| ITALY | 75,456 | 127,178 | 120,572 | 131,281 | 132,699 | 98,525 |

| AZERBAIJAN | 30,039 | 32,576 | 34,271 | 45,530 | 52,067 | 53,793 |

| USA (OREGON) | 40,000 | 35,000 | 40,000 | 50,000 | 49,000 | 52,000 |

| OTHERS | 89,961 | 97,424 | 85,729 | 89,470 | 112,933 | 116,207 |

Source: www.stat.gov.az, www.nass.usda.gov, www.istat.it, www.ticaret.gov.tr, internal data.

The increase in hazelnut growing areas.

So far, we have seen that the investment conditions for hazelnut producers have been favorable since 2014, with attractive income prospects and various forms of incentives, both public and private.

The main consequence is a drastic increase in hazelnut growing areas worldwide. Insiders know that investments have been made in several Eastern European and Asian countries; however, as exhaustive data are not available in many cases, we will focus on the evolution in Italy, Azerbaijan and the United States, where, according to official statistical sources, the hectares of hazelnut growing areas went from 115,000 in 2014 to 186,000 in 2019. We are talking about an increase of over 60%, whose effects on global production are not yet fully visible, since only just over half is already producing hazelnuts.

The news from Chile are consistent with this picture: 8,500 hectares in 2014, and 30,000 hectares estimated for 2020.

The dynamics that can be observed in these countries, which today represent about 30% of world output – more than 70% if we exclude Turkey – give more than a clue to the current trends. And hazelnut growing areas worldwide continue to increase, inside and outside their borders. Moreover, in these countries the yield per hectare is significantly higher than in Turkey, consequently the increase in their production share will be well above the share of cultivated area.

Table 2 – Hazelnut growing areas in the main hazelnut producing countries.

| 2014

(HA) |

2014

SHARE (%) |

2019

(HA) |

2019

SHARE (%) |

2014-2019

INCREASE(HA) |

2014-2019

INCREASE (%) |

|

|---|---|---|---|---|---|---|

| TOTAL | 824,642 | 100% | 923,146 | 100% | 98,503 | 12% |

| TURKEY | 701,141 | 85% | 706,700 | 77% | 5,559 | 1% |

| ITALY | 72,125 | 9% | 86,725 | 9% | 14,600 | 20% |

| AZERBAIJAN | 30,550 | 4% | 79,486 | 9% | 48,936 | 160% |

| USA (OREGON)* | 12,141 | 1% | 20,234 | 2% | 8,094 | 67% |

| CHILE | 8,686 | 1% | 30,000 | 3% | 21,314 | 245% |

*Only bearing hectares

Source: www.stat.gov.az, www.nass.usda.gov, www.istat.it, www.ticaret.gov.tr, internal data

What is the future of the market price and what role will Turkey play?

It is, therefore, reasonable to assume that further investments will be made and that there will be an increasing availability of the product on the market. Of course, non-traditional areas will have to prove that they can produce quality hazelnuts with high yields per hectare. It is also true that in many countries where hazelnut growing areas are limited, future production will be widely allocated to the domestic market and will not affect international dynamics.

However, there is no doubt that, regardless of the ability of the confectionery industry – the main product consumer – to increase its demand, the quantity of product on the market in the years to come will be such that an impact on its prices will be inevitable. This circumstance will make orchards with a lower yield per hectare and higher production costs less profitable. Furthermore, any excess stock will remain in those countries or areas in which product quality, traceability and sustainability are perceived as critical factors, such as in Turkey.

What will be the role of Turkey in the future?

By supporting the market price and avoiding correcting the critical issues of the supply chain, linked to quality and social sustainability, Turkey has definitely made a decisive contribution to the recent growth of hazelnut cultivation across the world. In the future, in a market where demand is rapidly changing towards sustainable and high-quality products, its share in the world production is doomed to decrease, undermining the authorities’ ability to influence the international market price. Without any intervention, many production areas would disappear, but recent history and the importance of the sector at a political and economic level suggests that this is unlikely to happen.

Among the different options available, an alternative to support policies would be intervening on the supply chain in order to reorganize the sector, incentivizing production in suitable and mechanizable areas, providing large scale training on good agricultural practices and a lasting solution to the alleged child labour issue. Anything but simple.